Hello Sunshine.

Madami akong nai encounter sa mga FB groups about tipid living and how to be frugal. Saludo ako on how they manage their finances amidst the limited income.

Me and my family been struggling financially. Kahit noong 2 pa kami nag nagtatrabaho sobrang wala kaming ipon and naipundar. DI rin kasi kami mahilig magbenta benta on our day off. Priority namin ang pahinga since on our day off anjan na nakatambak ang labada, maglilinis ng bahay, mamamalengke at of course magpahinga. Siguro sa iilan ginagawa nilang night ang day at mostly sa kanila ay di na nagpapahinga. Sa type ng work namin hindi pwede na hindi ka matutulog ng 6 hours or more kasi mahirap ang trabaho. Katawan mo naman ang magbabayad neto later on.

Sometime nga sleep deprive pa lalo nung maliit pa lang ang anak namin. Wala kaming yaya or kasambahay. Kami kami lang juggling work, house chores and parenthood.

Ngayong pandemic we are solely dependent of single household income. Sometimes sumasideline ako para magkaron ng pandagdag. So san nga ba napupunta ang pera namin.

I know madami sa inyo magsasabi na pag aralan ang mga insights ni Mr. Chinkee Tan. Pero if your resources are limited how are you going to manage? Yun iba sasabihin magdagdag ng extra income stream? Do you mind if I ask how? Mag online seller? Saturated na eto and some of them ay natetengga lang ang tinda and not getting the returns. Mag sari-sari store? Puro utang yan sa lugar namin. Magtinda ng kakanin? Lahat na yata ng household dito sa lugar namin may sariling tinda. Mag ice candy? Yun mga bata naumay na.

Sa panahon ngayon a decent income to survive daily should be 25k. What if we fall below that line? The minimum is at P15k. How are we going to survive having that much only? Where ang lahat ng food commodities nagmamahalan? Hindi naman pwede mag delata at mag noodles na lang palage or our health will suffer.

So tell me mga Sunshine how do you do it? Kasi ako hindi ko magawa. I wish I can save for the rainy days pero bago pa man magsweldo ay petsa de peligro na.🥺

Yun iba nakakapagpundar ng bahay, sasakyan at munting negosyo. I wish ako rin. Kami rin.. But how?

#struggles

~~~~~~~~~ 💗 ~~~ 💗 ~~~ 💗 ~~~ 💗 ~~~ 💗 ~~~ 💗 ~~~~~~~~

***Not Paid Post. Reviews are my own personal experience and opinions.

Follow me and I will follow you 😍 😘

📸 IG

🧾 FB Page

🎬 Youtube

📧 Email/Business/Collab: wengthoughts@gmail.com

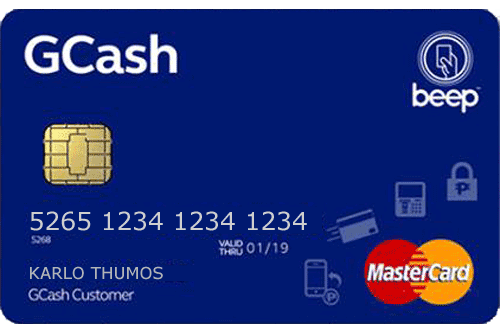

That's 311ECD. Have it verified. Submit a picture with your ID. An agent will call you for verification purposes and once you are verified you will get the KYC code via SMS and that is the time you can cash in or deposit in your

That's 311ECD. Have it verified. Submit a picture with your ID. An agent will call you for verification purposes and once you are verified you will get the KYC code via SMS and that is the time you can cash in or deposit in your